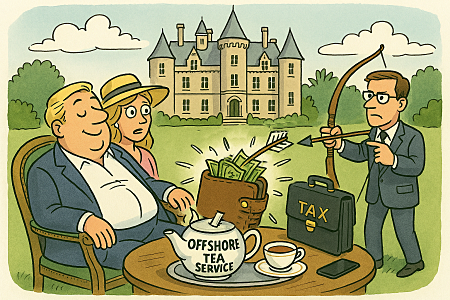

HMRC focuses on:

- High-net-worth individuals with complex holdings,

- Suspicious UK tax affairs that justify deeper scrutiny and

- Pensioners on Pension Credit.

(For more, including bank snooping, CLICK HERE & HERE )

Even for AML database entries, a person is more likely to be struck by lightning twice in the same year than to be investigated as to overseas assets.

HMRC cannot go on a fishing expedition. They have to target a particular individual each time.

Barny’s Verdict:

“Unless you ping the radar, you’re just another dot in the fiscal fog.”