🏛️ DWP Bank Monitoring: Legal Reach, Policy Focus, and the Pensioner Risk

As the UK government expands its fraud detection powers, a new system is emerging—one that quietly reshapes the relationship between claimants, banks, and the Department for Work and Pensions (DWP). While the public narrative focuses on means-tested benefits, the legal net is far wider, and the technical rails are already laid.

🔍 What’s Changing

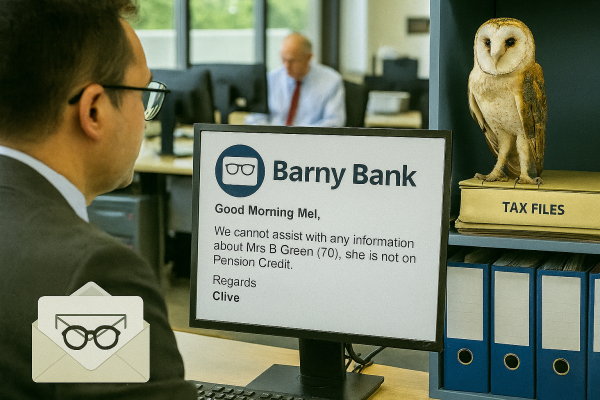

Under the Fraud, Error and Debt Bill, banks will be required to flag accounts that breach savings thresholds for means-tested benefits like Universal Credit. For example, if a U.C. claimant’s account consistently holds over £16,000, the bank must alert the DWP.

This flagging mechanism now extends to other means-tested benefits, including Pension Credit and the Winter Fuel Allowance. While the Winter Fuel Payment is still issued automatically, pensioners with annual income above £35,000 may be required to repay it via their tax return. Claiming the payment while exceeding the income cap may trigger HMRC’s income verification process—based on interest feeds, not full account access.

This mechanism does not involve full account surveillance. Instead, it triggers automated alerts when savings or income breach eligibility thresholds for the means-tested benefits being received.

- No direct access: The DWP cannot view full transaction histories or spending habits.

- No automatic deductions: The government cannot withdraw funds from accounts.

- Threshold-based alerts only: Banks act as sentinels—not surveillance agents.

📜 What Counts as a “Benefit”?

The legislation defines “benefits” broadly—not just means-tested, but any income provided by the government that isn’t earned through direct employment.

This includes:

- State Pension

- Pension Credit

- Disability Living Allowance

- Personal Independence Payment

- Attendance Allowance

- Carer’s Allowance

If the government truly intended to limit its reach to means-tested benefits, it would have written the law to reflect that constraint. It didn’t. The current focus is pure policy, not legal limitation.

🧓 Pensioners: Technically Within Scope

Because pensions are legally classified as benefits, pensioners fall within scope—even if they’re not currently monitored.

- As fiscal pressure grows, older people with savings may become strategic targets for recovery.

- The system’s architecture already supports broader surveillance—it’s just waiting for a policy pivot.

🏦 Banks Will Leak Policy Changes

Banks—especially foreign-owned ones—have no intrinsic loyalty to UK policy aims. If instructed to monitor new thresholds or flag pensioners, they will leak the changes, intentionally or via internal dissent.

- Instructions to banks cannot be hidden—they must be operationalised.

- Any shift in surveillance scope will ripple through the banking sector before reaching claimants.

- There will be fair warning—because banks will leak. We know they will.

🔄 Policy Drift: From Thresholds to Triggers

Today’s system flags savings over £16,000 for Universal Credit.

Tomorrow’s system could flag:

- “Unusual reserves”

- “Unreported income streams”

- Pension drawdowns or asset transfers

The technical rails are already laid. Policy is the only brake.

🛡️ Motif Clarity: What’s Fixed, What’s Fluid

This is a classic motif moment:

- Legal Net: The law includes all benefits, not just means-tested ones.

- Policy Lens: The current focus is narrow—but that’s a choice, not a safeguard.

- Trigger Rails: The system can expand without new legislation—just a change in guidance.

Claimants and pensioners alike should understand that today’s exclusions are not permanent protections.

Social media

Protect your future!

Copyright © 2025 quiteamazing.uk